Young Professionals – Tracking Your Spending

Shahadat Hossain - pexels.com

Being aware of our spending patterns is extremely important especially if we are saving for a particular financial goal such as a holiday or a car.

I’m not particularly fond of the term ‘budget’ as this implies setting restrictions, however, I think that everyone should have an awareness of where they are spending their money.

How To Track Your Spending

To do this, it makes sense to track your spending and this can be done by either looking back at previous bank statements, say, for the last three months, or by tracking your spending over, say, the next 30 days.

Some people like to do this using an excel spreadsheet – and if you are an excel geek like me you can spend hours designing it – or you can simply use a notepad and pen!

Benefits of Tracking Your Spending

By tracking your spending you can identify what, where and how you’re spending your money and, if necessary, make any changes depending on your financial goals.

Spending Strategy

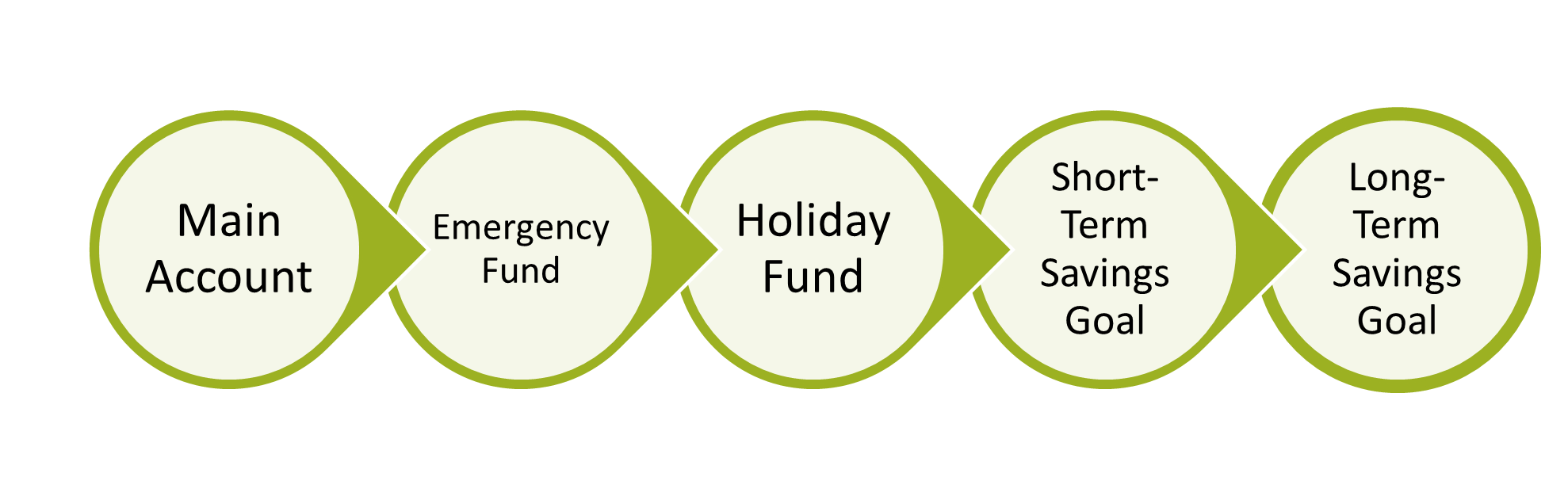

There are a number of ways to be more intentional around how you spend your money and I find creating different ‘pots’ helps and this may involve setting up a number of different online bank accounts depending on your goals as well as a longer-term savings pot.

The following is an example of this approach:

Planned Spending Strategy

The main account is your current account into which your salary is paid and from which all of your bills and direct debits are paid.

Assuming that you have money left over each month – and by tracking your spending you will have a rough idea how much surplus you typically have – you may want to move some money into a second account, say, an instant access deposit account, in order to create an emergency fund. This can equate to around three months’ worth of expenditure and can be drawn upon in the event of an emergency.

Depending on your financial goals, you can open further accounts and pay some money to help towards these. In the above example, we can create a holiday fund or it could be another short-term savings goal.

Finally, any surplus income can be channeled towards a long-term saving goal and this is likely to necessitate a different type of savings vehicle such as a Stocks and Shares ISA. I have assumed that you are saving for your retirement and will have joined your Workplace Pension.

A Balancing Act

It is important to strike a balance between enjoying a good lifestyle today and laying solid foundations for your future lifestyle. Also, over time, it is important to review your spending patterns to ensure that they are best serving you. For example, as your career progresses and you receive salary increases, you may find that you are accumulating large cash balances which could be better directed towards the long-term savings pot.

You may also find that your salary increases such that you have crossed a tax threshold and a pension contribution might be more worthwhile to bring your overall tax liability down.

It does take some effort to track your spending and it may not be particularly exciting but having an understanding of where you’re spending your money can put you in a better position to move towards fulfilling your short-term savings goals as well as laying the foundations for longer term financial security.

Contact Us

If you would like to find out more about our Foundation Financial Planning service and how we can help young professionals, please do get in touch using the button below.