Retirement: Wealth and Health

Pixabay - Pexels

There have been a number of recent reports that have highlighted the challenges facing those planning for their retirement, both in terms of their wealth and, just as importantly, their health.

Retirement Income

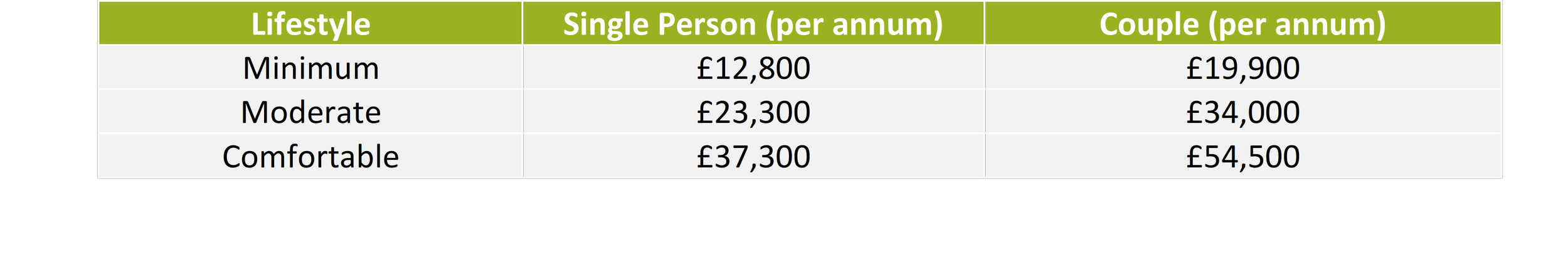

The Retirement Living Standards 2022 update from the Pensions and Lifetime Savings Association (PLSA) in association with Loughborough University looks at the level of income needed to fund different kinds of lifestyle in retirement, from a minimum to a comfortable lifestyle.

The figures are as follows and have increased significantly over the past year or so due to the current high levels of inflation:

Source: retirementlivingstandards.org.uk

So what does a comfortable lifestyle look like? According to the PLSA, this includes:

Replacing the kitchen and bathroom every ten to fifteen years.

Spending £238 per week on food including eating out.

Owning two cars each replaced every five years.

Three weeks holiday in Europe every year.

Spending up to £1,300 per person on clothes and footwear every year.

Spending £56 each year on birthday presents.

How Much Do You Need?

The key question that anyone planning for their retirement needs to know is how much capital is required to provide a comfortable level of income? There are, of course, different approaches that can be taken, for example, the PLSA assumes that an annuity is purchased.

I will take a different approach and, firstly, we’ll assume that the £54,500 income figure is the net amount required and that we should take into account that tax is likely to be paid on the income. Assuming a basic rate of tax of 20%, the level of income required becomes £68,125 per year.

As a very rough rule of thumb, we could apply a 4% withdrawal rate - a percentage often quoted as being a ‘safe’ withdrawal rate whilst preserving capital. A couple would therefore need capital of £1,703,125.

Your Ideal Lifestyle

The figures used by the PLSA, whilst useful, are not a substitute for an individual financial plan which takes into account your specific retirement plans, whether this includes an extended period of travel, several European holidays, a family holiday home or a complete home makeover.

A bespoke financial plan can model different scenarios and take into account different phases of retirement, for example the early part of retirement may involve a significantly higher level of expenditure. It can also take into account capital withdrawals and not just income. It can also look at how your wealth can be passed tax efficiently to the next generation.

Health & Lifestyle

Wealth is only one aspect of a successful retirement.

According to ‘The State of Ageing 2022’ report, carried out by the Centre for Ageing Better, the state of ageing in England is getting worse.

Life expectancy has declined in 2022 by 0.3 years for women and by 0.4 years for men.

The number of years people live in good health has also declined with men expected to live for 62.4 years in good health without a disabling condition and women for 60.9 years.

The number of people in mid to later life who live alone has increased with 1.3 million men aged 65 and over living alone, up 67% compared to the period 2000 to 2019.

It is not all doom and gloom, however:

According to figures from the last census (2021), the number of centenarians has reached an all-time high largely due to the spike in births following the end of World War 1.

There are twice as many women aged 90 and over compared to men.

Conclusion

So what do these reports tell us about our retirement planning?

We need to start saving as early as possible and as much as possible.

We should start planning several years before retirement to design the lifestyle we want to lead and obtain a cashflow forecast. This will show whether our plans are on track or it might show that we need to increase our savings levels.

Wealth is only one aspect of retirement and we need to ensure that we maintain and nurture our health and our relationships leading up to and into retirement.

And finally…

If you are a nonagenarian single male, things are looking up!

Want to Plan Your Ideal Lifestyle?

Do get in touch with us for a free, no obligation chat to see how we may be able to help you with your retirement plans.